Last Wednesday i brought a few lots of Singtel at 2.48....

Sold it for 2.52 today... Reason being the market seem to heat up and cool off rather quickly this few days... 2 days ago when the news 1st mention about the swine flu it went diving... but yesterday they announce that this swine flu is spreading fast, but it seem that it does not bother the traders anymore... I am playing safe, who know will this be like the next SARS

And also it end of my contra period so let it go for a very small profit...

Wednesday, April 29, 2009

Tuesday, April 28, 2009

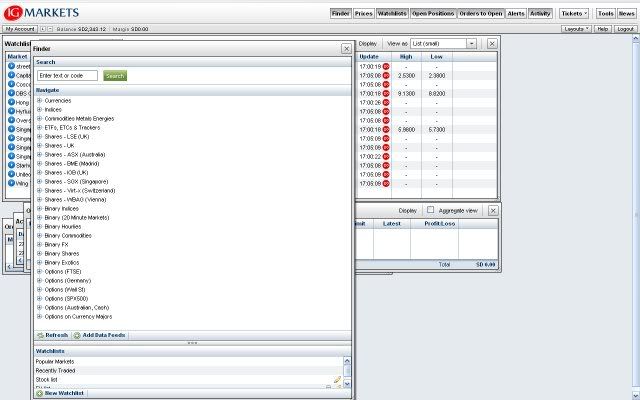

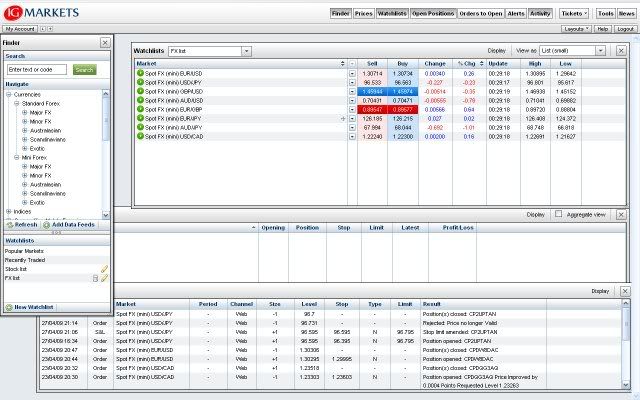

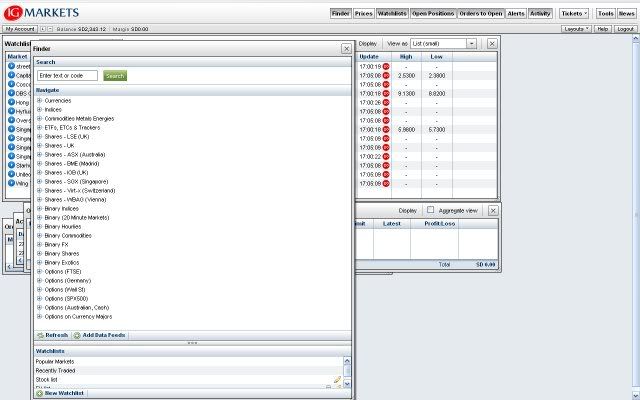

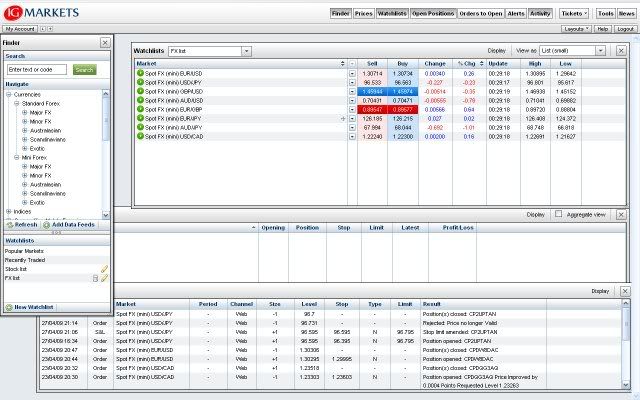

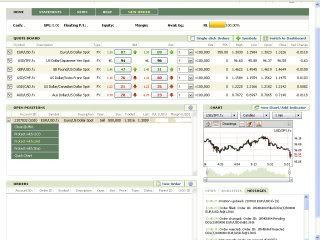

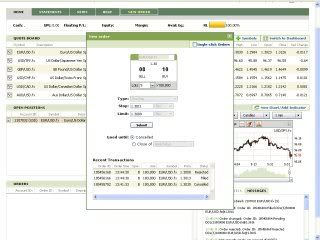

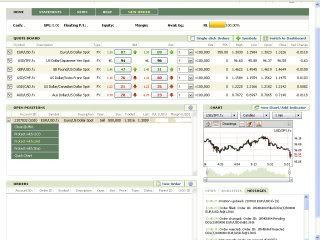

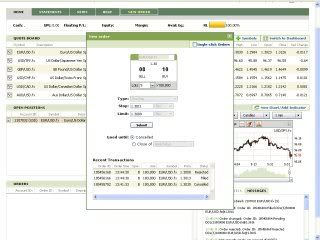

IG Market platform

Next up is Puredeal from Igmarket, personally i am using igmarket platform as i like it the best.

Therefore if after reading my review, you wish to open a igmarket account let me know so i can refer you as a friend. We can split any reward given for referring.

All the broker i review are MAS regulated in short your money is save with them, even if the brokerage close down.

You are also able to trade CFD with IG market but their data feed is delayed, if u want live data feed you will need to pay a small fee or complete a number of trade depending on the live data you want. Their commission is $25 per trade and the roll over is 2.5% + SIBOR

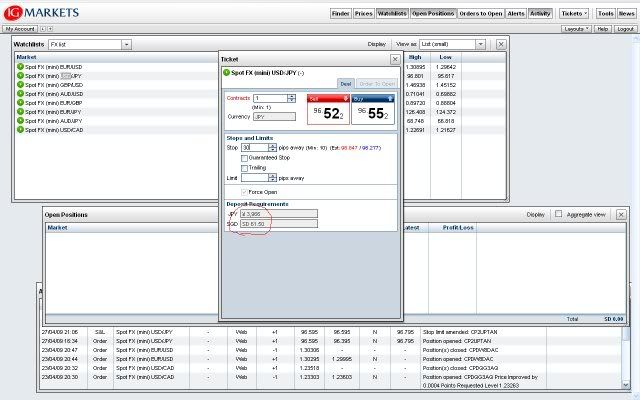

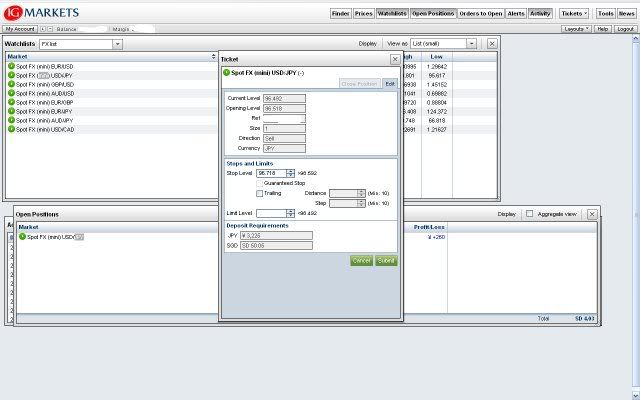

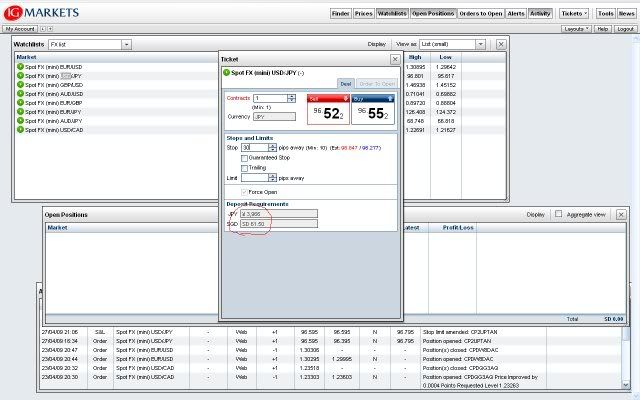

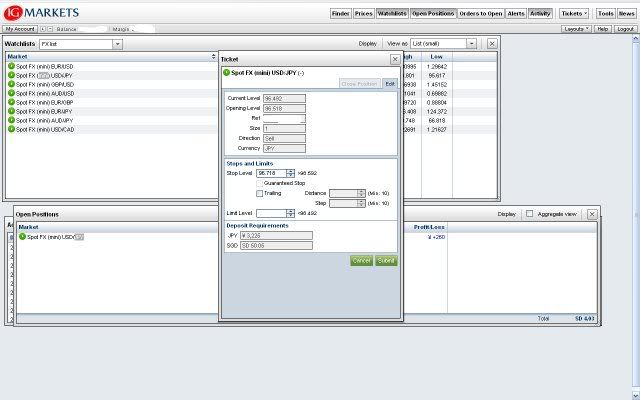

The thing i like about IG is the margin, if u place a stop loss level before u enter a trade it will only use that amount of pips as the margin, therefore allowing you to have more balance to enter more trade. Another thing is their stop loss, all you need is to enter the amount of pips u want instead of counting the number yourself.

And also they have guaranteed stop loss (need to pay 3 additional pip for this)

Editing your stop n limit level is also a breeze....

I did hear some of them complaining of lag, browser being unstable, order did not go thru....

But i have not face any of thes problem myself therefore i am unable to comment on that...

Therefore if after reading my review, you wish to open a igmarket account let me know so i can refer you as a friend. We can split any reward given for referring.

All the broker i review are MAS regulated in short your money is save with them, even if the brokerage close down.

You are also able to trade CFD with IG market but their data feed is delayed, if u want live data feed you will need to pay a small fee or complete a number of trade depending on the live data you want. Their commission is $25 per trade and the roll over is 2.5% + SIBOR

The thing i like about IG is the margin, if u place a stop loss level before u enter a trade it will only use that amount of pips as the margin, therefore allowing you to have more balance to enter more trade. Another thing is their stop loss, all you need is to enter the amount of pips u want instead of counting the number yourself.

And also they have guaranteed stop loss (need to pay 3 additional pip for this)

Editing your stop n limit level is also a breeze....

I did hear some of them complaining of lag, browser being unstable, order did not go thru....

But i have not face any of thes problem myself therefore i am unable to comment on that...

Forex trading platform

There seem to be hundreds of trading platform out there, and when i first got to know FX trading the first question in my mind is which platform to use.... lucky i got some "teacher" from terraseeds where i attend my FX course told me what to look for.... I will review on some of them,

like IG, CMC, GFT and CITY INDEX let just start with these four of them.

Please note that you can sign up for a demo account from any of the broker

I will start with GFT platform first.

They have 3 platform application base, web base and mobile base, i have only tried their web base thereform i can only review on that....

GFT have the cleanest outlook of all the no nonsense forex only interface (GFT currently only have forex trading) let user easily add and remove pairs from their watchlist. They have most of the needed window like price, pending orders, open orders, charts and alerts nicely fitted into ur main window.

To edit orders is also a breeze click on the open order and set ur limit, stop or oco from there, but it seem like you would need to open a postion before u can edit ur stop which can be dangerous during heavy trading hours.

As for the spread, they have quite similar spread as other brokerage... 1 for Euro... 2 for Yen... 2 for Sterling... 2 for Swiss but note they do not have a fix spread... i was also told althought they do not have fix spread but their spread have been quite constant over the years

Another point to take note is that they do not have mini contact, and they stop at 2 decimal place it mean that ur profit will only be in round figure like $1 or $2.

But GFT got Kathy Lien as their spoke person this a real big plus... her class and insight of the market is really very enriching...

like IG, CMC, GFT and CITY INDEX let just start with these four of them.

Please note that you can sign up for a demo account from any of the broker

I will start with GFT platform first.

They have 3 platform application base, web base and mobile base, i have only tried their web base thereform i can only review on that....

GFT have the cleanest outlook of all the no nonsense forex only interface (GFT currently only have forex trading) let user easily add and remove pairs from their watchlist. They have most of the needed window like price, pending orders, open orders, charts and alerts nicely fitted into ur main window.

To edit orders is also a breeze click on the open order and set ur limit, stop or oco from there, but it seem like you would need to open a postion before u can edit ur stop which can be dangerous during heavy trading hours.

As for the spread, they have quite similar spread as other brokerage... 1 for Euro... 2 for Yen... 2 for Sterling... 2 for Swiss but note they do not have a fix spread... i was also told althought they do not have fix spread but their spread have been quite constant over the years

Another point to take note is that they do not have mini contact, and they stop at 2 decimal place it mean that ur profit will only be in round figure like $1 or $2.

But GFT got Kathy Lien as their spoke person this a real big plus... her class and insight of the market is really very enriching...

Market outlook this week

STI index close lower by 32.240 today closing at 1818.610 due to the swine flu...

Kind of glad i cut loss on my SGX last friday...SGX close at 5.880 today....

More new on the swine flu.....

"Swine flu spreads economic shivers"

PARIS : The global outbreak of swine flu sent shivers through financial markets on Monday... more

"Stock markets dive on swine flu fears"

LONDON - Global stock markets mostly tumbled on Monday as investors took fright at a swine flu outbreak .... more

SOURCE: Channel News Asia

Dun look good for the market this week....

Kind of glad i cut loss on my SGX last friday...SGX close at 5.880 today....

More new on the swine flu.....

"Swine flu spreads economic shivers"

PARIS : The global outbreak of swine flu sent shivers through financial markets on Monday... more

"Stock markets dive on swine flu fears"

LONDON - Global stock markets mostly tumbled on Monday as investors took fright at a swine flu outbreak .... more

SOURCE: Channel News Asia

Dun look good for the market this week....

Monday, April 27, 2009

Long USD/JPY

As what i posted on Saturday that it look good to long this pair...

Enter at 96.595....stop 20 pips... limit 20 pips....

Ratio 1:1 is strongly not recommend but as there not much movement in the market now, if it fall below 96.4 i know that my analysis is wrong...and for it to go above 96.8 might be too tough for this pair....

after i enter it look like it dropping again...let see will it hit my stop loss...

Aftermath - wanted to take profit at 96.76 about 3 pips from my target lv, but my stupid com for no reason mess up my web browser and i am unable to login my account to take profit....in the end i took profit at 96.7...ANGRY but after some thought..ok la i still got 11 pips...

Reason i took profit earlier then expect is because after watch this pair move it see it does not have the power to move up at least not for now... But it is really a pair that look good to long....

will long this pair again in a later time or maybe tml morning....

Those lines are equal distance, fibo channel, and fibo lv

Enter at 96.595....stop 20 pips... limit 20 pips....

Ratio 1:1 is strongly not recommend but as there not much movement in the market now, if it fall below 96.4 i know that my analysis is wrong...and for it to go above 96.8 might be too tough for this pair....

after i enter it look like it dropping again...let see will it hit my stop loss...

Aftermath - wanted to take profit at 96.76 about 3 pips from my target lv, but my stupid com for no reason mess up my web browser and i am unable to login my account to take profit....in the end i took profit at 96.7...ANGRY but after some thought..ok la i still got 11 pips...

Reason i took profit earlier then expect is because after watch this pair move it see it does not have the power to move up at least not for now... But it is really a pair that look good to long....

will long this pair again in a later time or maybe tml morning....

Those lines are equal distance, fibo channel, and fibo lv

Sunday, April 26, 2009

Disclaimer

Although i dun think anyone will to read my blog but i think it better to have a Disclaimer in case people come and sue me....lol...

So here goes.......

DISCLAIMER

MARKET OPINION

Any opinions, news, research, analyses, prices, or other information contained on this website are provided as general market commentary, and do not constitute investment advice. I am not liable for any loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

PRODUCT AND SERVICES

All product and service mention in my blog are purely my personal feeling and opinion. I do not represent any company or individual. I am not liable for any loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on such information on the mention product and services.

IF ANY PRODUCT OR SERVICE BELONG TO YOU AND YOU WOULD LIKE IT TO BE REMOVE FROM MY BLOG

YOU CAN EMAIL ME @ DAWN_NITE@HOTMAIL.COM

So here goes.......

DISCLAIMER

MARKET OPINION

Any opinions, news, research, analyses, prices, or other information contained on this website are provided as general market commentary, and do not constitute investment advice. I am not liable for any loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

PRODUCT AND SERVICES

All product and service mention in my blog are purely my personal feeling and opinion. I do not represent any company or individual. I am not liable for any loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on such information on the mention product and services.

IF ANY PRODUCT OR SERVICE BELONG TO YOU AND YOU WOULD LIKE IT TO BE REMOVE FROM MY BLOG

YOU CAN EMAIL ME @ DAWN_NITE@HOTMAIL.COM

Saturday, April 25, 2009

Some Forex trade to think about USD/JPY

There are 2 trade that i am looking at currently.... Long USD/JPY and Short EUR/USD....

Here the analysis on Yen, shorting of Euro i will come out with on the 1st week of May as "The Godfather" say he is going to cut interest rate for the Euro in May...and everybody believe he will....

Long USD/JPY

H1 Chart

H4 Chart

Yellow = Support Level

Green = Fibo level

Dotted blue line = Pivot level

It seem that Yen manage to test Week pivot S2 but if u can see as soon as it close below

S2 the next candlebar close higher showing that this pivot is a good support

There also some good support seen like the yellow support line i draw and the fibo level

This show a strong confluence level.

But i will see how the market fair on monday, a good entry point will be below 97 stop around 30pips and limit around 98

Here also some analysis on Yen from FX360

"USD/JPY: Strong Buy on Dip to 97.25"

Our intraday technical reports have been tracking this bullish setup all week long as each day has essentially brought more and more confirmation on a potential buy at..... more

SOURCE: FX360

If i have a chance i will share more on how fibo level works and some trading styles.

Here the analysis on Yen, shorting of Euro i will come out with on the 1st week of May as "The Godfather" say he is going to cut interest rate for the Euro in May...and everybody believe he will....

Long USD/JPY

H1 Chart

H4 Chart

Yellow = Support Level

Green = Fibo level

Dotted blue line = Pivot level

It seem that Yen manage to test Week pivot S2 but if u can see as soon as it close below

S2 the next candlebar close higher showing that this pivot is a good support

There also some good support seen like the yellow support line i draw and the fibo level

This show a strong confluence level.

But i will see how the market fair on monday, a good entry point will be below 97 stop around 30pips and limit around 98

Here also some analysis on Yen from FX360

"USD/JPY: Strong Buy on Dip to 97.25"

Our intraday technical reports have been tracking this bullish setup all week long as each day has essentially brought more and more confirmation on a potential buy at..... more

SOURCE: FX360

If i have a chance i will share more on how fibo level works and some trading styles.

Friday, April 24, 2009

Short SGX @ 6.02

CFD Short SGX @ 6.02 1300 Shares (24/4)

It Friday... normally market will be weak on friday, therefore i short SGX... with a commission of $16 per trade i need at least it to drop to 5.98 to break even....let see how it goes....

Aftermath - buy back at 6.08...should have taken profit at 5.96... and due to my stupid mistake i key in the wrong number of share which cost me another $15 buck... make a total loss of 140...damn wat a bad day for me

It Friday... normally market will be weak on friday, therefore i short SGX... with a commission of $16 per trade i need at least it to drop to 5.98 to break even....let see how it goes....

Aftermath - buy back at 6.08...should have taken profit at 5.96... and due to my stupid mistake i key in the wrong number of share which cost me another $15 buck... make a total loss of 140...damn wat a bad day for me

Sold SGX at a loss

Brought SGX @ 6.08 1 lot (20/4)

Brought SGX @ 6.02 1 lot (22/4)

SGX have been dropping from 6.18 to 6.08... i tot it was a good buy and i went in....i was to hasty did not check the charts and wat is happen around it went below 6 on the same day...

2 day later it was trading around the range 6.00 - 6.05 went in at 6.02...and it went down again...

Sold SGX @ 6.02 2 lots (24/4)

Sold at a loss of $120...reason being it a friday, most ppl are afraid to hold their stock over the week end plus today Banks Stress coming out.... i believe the stress test report will show some good result. As bank around the world have step up to try and recover the economy the result should not be too bad.... But i am not willing to risk it....

Aftermath- SGX shoot up to 6.09 should have hold.... i might even make a profit if i hold... damn bad day for me...

Brought SGX @ 6.02 1 lot (22/4)

SGX have been dropping from 6.18 to 6.08... i tot it was a good buy and i went in....i was to hasty did not check the charts and wat is happen around it went below 6 on the same day...

2 day later it was trading around the range 6.00 - 6.05 went in at 6.02...and it went down again...

Sold SGX @ 6.02 2 lots (24/4)

Sold at a loss of $120...reason being it a friday, most ppl are afraid to hold their stock over the week end plus today Banks Stress coming out.... i believe the stress test report will show some good result. As bank around the world have step up to try and recover the economy the result should not be too bad.... But i am not willing to risk it....

Aftermath- SGX shoot up to 6.09 should have hold.... i might even make a profit if i hold... damn bad day for me...

Post Number 1

This my 1st post of this blog..... hmmm...creating this blog is to keep track of wat i trade, and hopefully can use it as a guide and reference of wat i did right and wrong...

Subscribe to:

Posts (Atom)